April 11, 2025

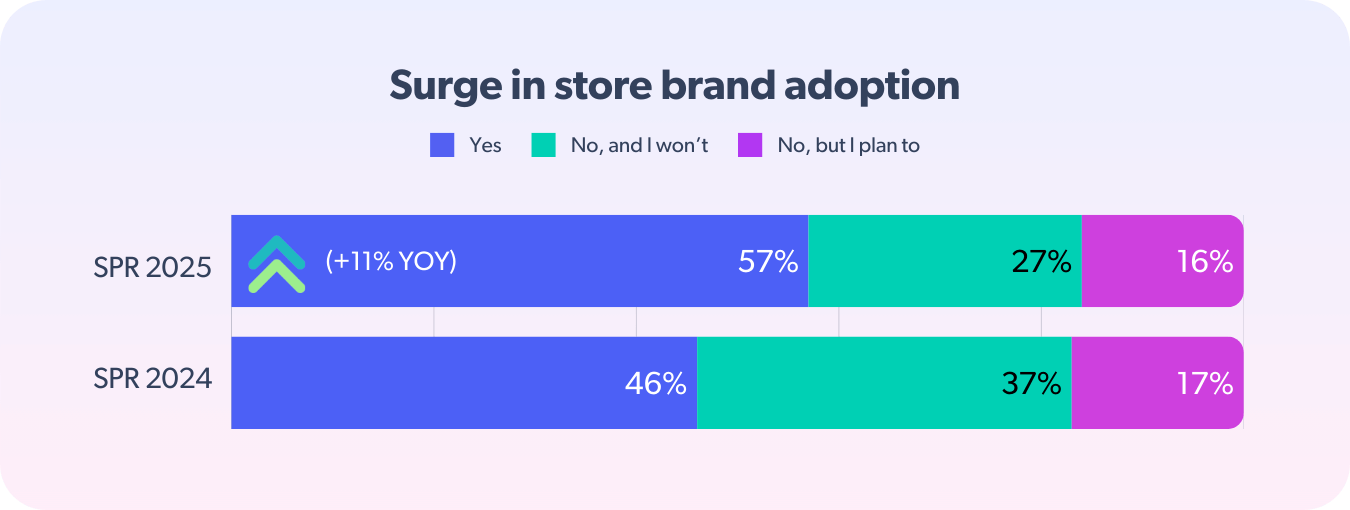

Consumer shopping habits are undergoing a significant shift, with a growing number of shoppers permanently opting for private label or store brands — products owned and sold directly by retailers. The latest Bazaarvoice Shopper Preference Report 2025 reveals a striking 11 percentage point surge in store brand adoption compared to last year.

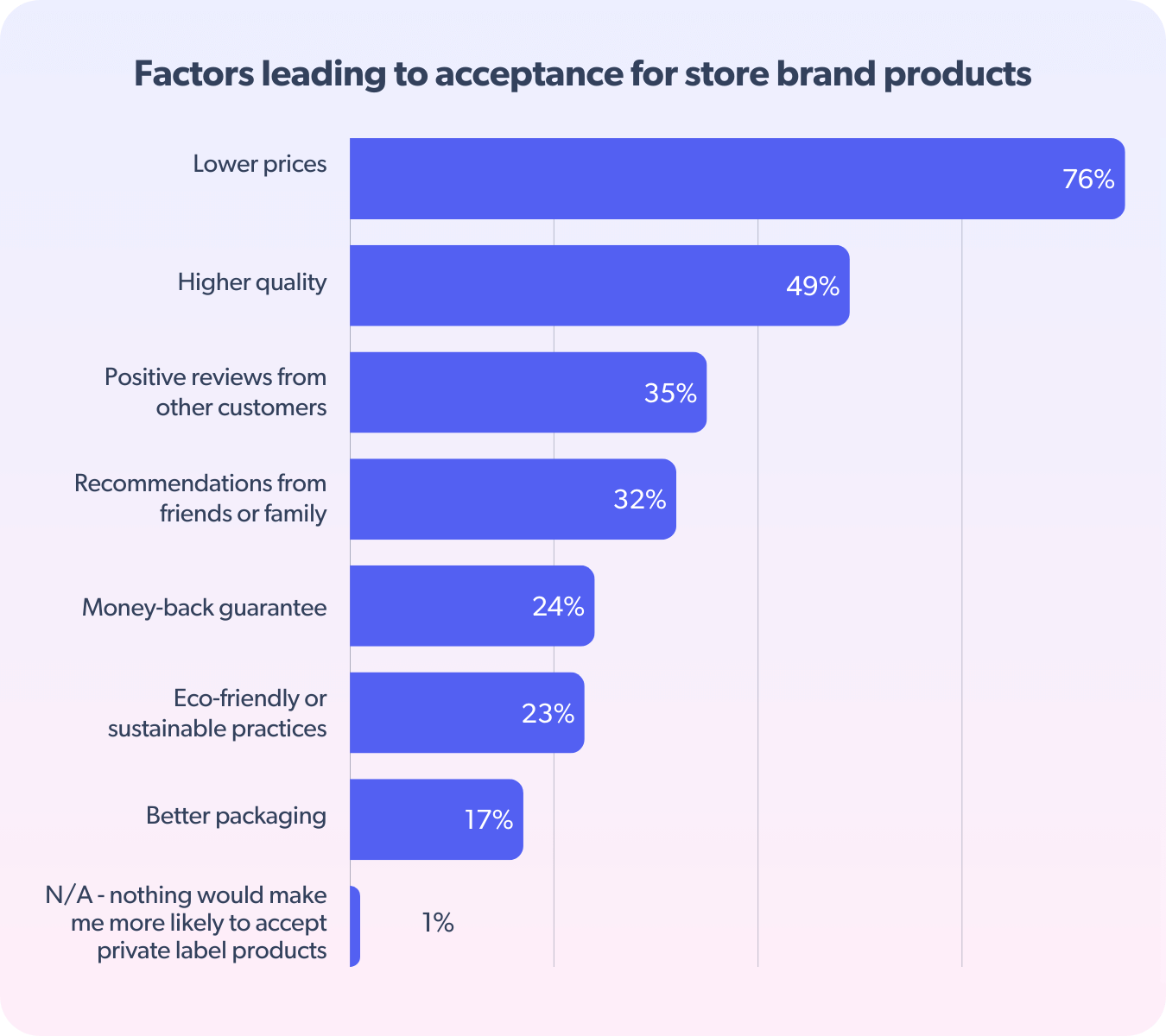

This surge directly correlates with economic uncertainty, as 76% of shoppers in all age groups cite lower pricing as the key motivating factor for accepting private-label products. Even better incentives have led 6 out of 10 shoppers to prefer the transition.

Keep reading as we unfold all the major aspects of the rise of private-label brands in 2025.

Economic factors driving private-label preferences

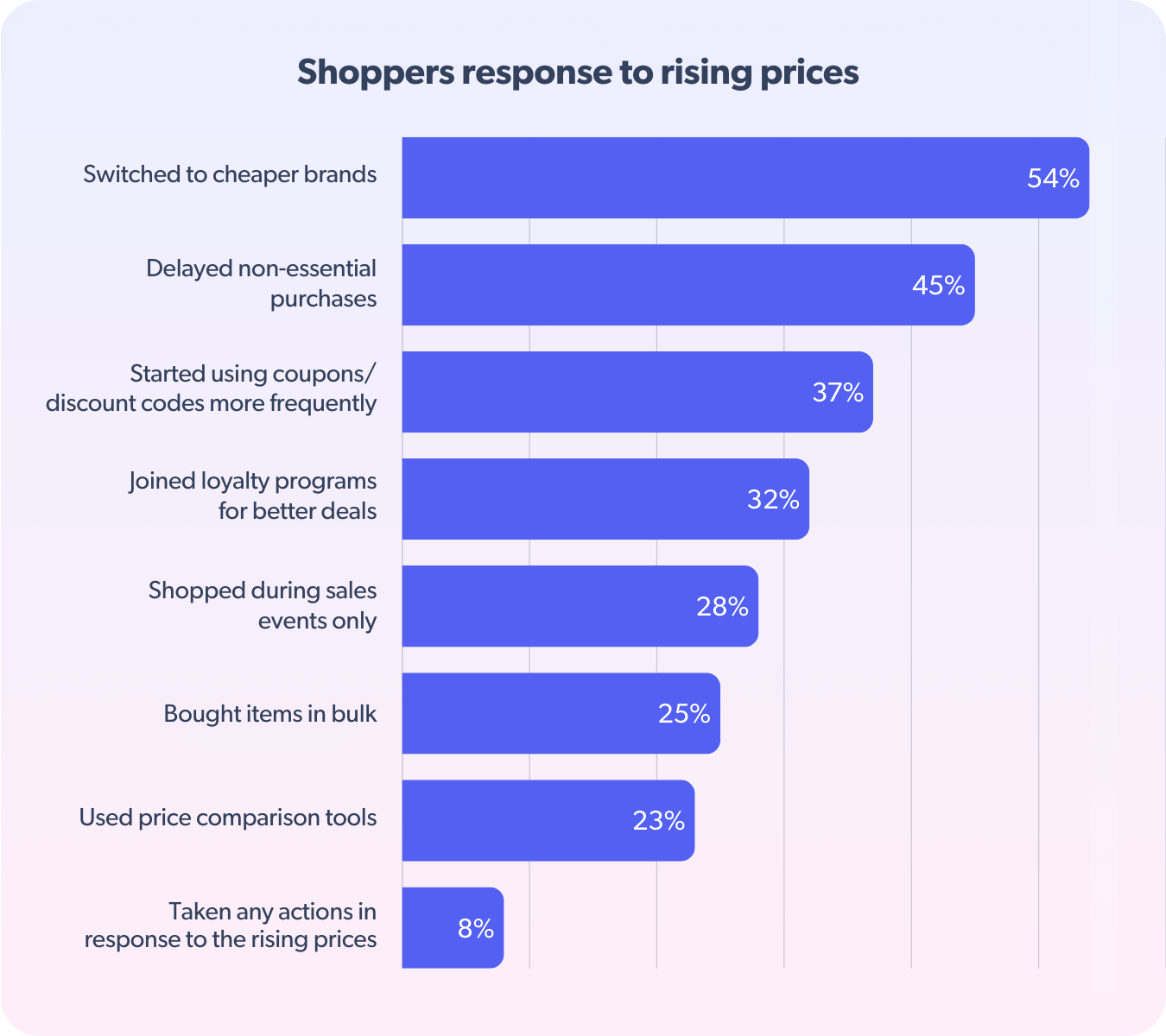

As challenging economic conditions persist, at least 47% of shoppers prefer to buy less overall. The data shows that to combat inflation, shoppers are comfortable switching to cheaper brands and more interested in using coupons/discount codes more frequently for purchases.

Now, where are the consumers shopping to fulfill their demands?

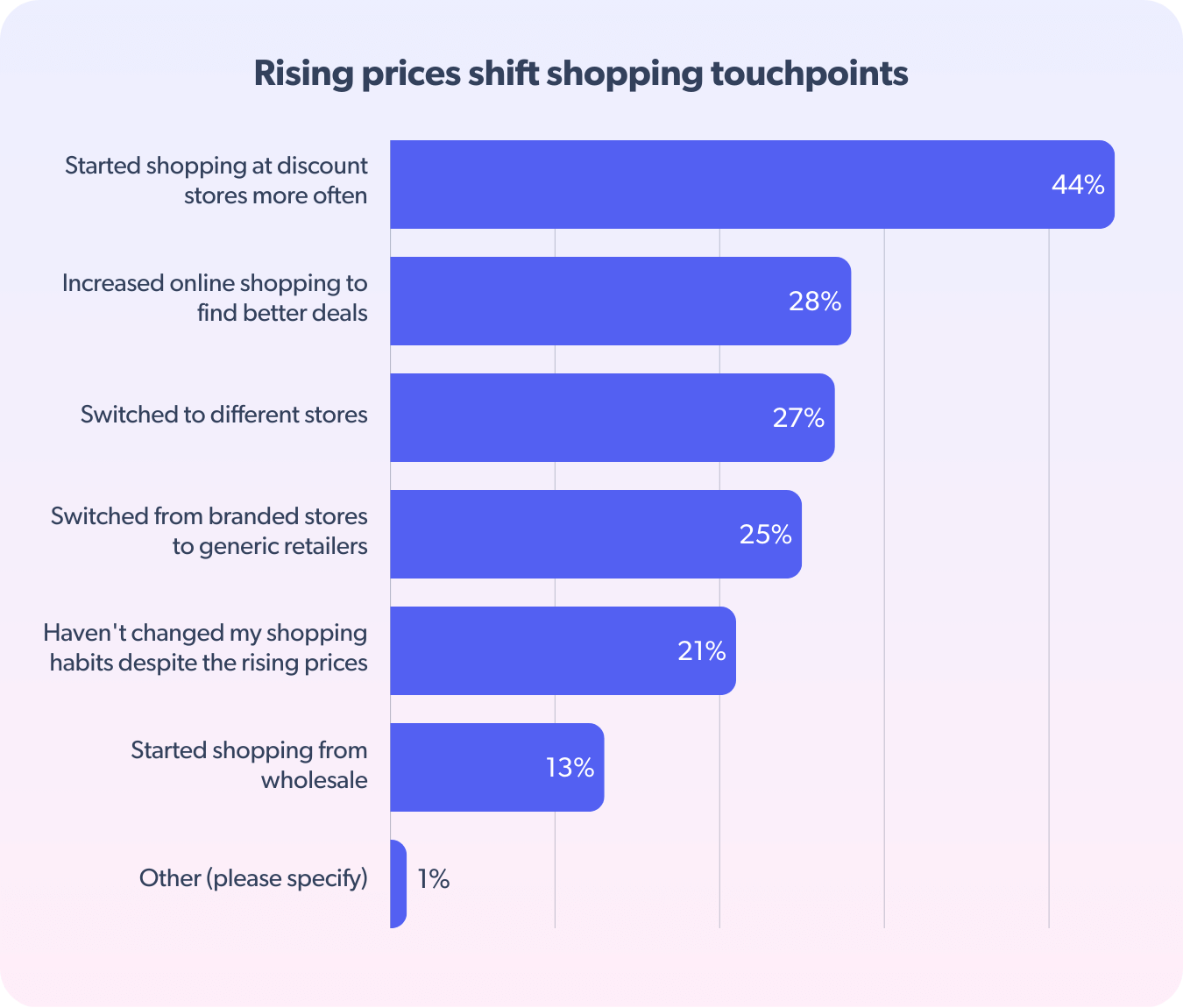

At least 44% of shoppers of all generations have started shopping at discount stores. Over the past year, one in four shoppers didn’t hesitate to switch from branded stores to generic retailers or different stores, highlighting a strong emphasis on affordability — one of the key reasons behind the rising adoption of private-label products.

From the statistics mentioned above, you can clearly spot the spending pattern- consumer savings trend.

Forces behind private-label product adoption

It’s clear that shoppers are seeking more affordable options. When explicitly asked whether they had permanently switched to a store brand over the past years, nearly 57% confirmed they had, indicating a strong acceptance. Compared to the report published in 2024, this number has increased by 11 percentage points.

Now, let’s look at the factors responsible for the widespread acceptance of private-label products. Lower prices, higher quality, and positive reviews have been the most motivating factors for shoppers to purchase.

Besides, at least 23% of shoppers actively consider eco-friendly and sustainable practices as one of the reasons for purchasing a private-label product. Quickly adapting to evolving shopper behavior, Monoprix — a major French retail chain — expanded its Bio product range in 2021 and rebranded it as Bio Origines. These items are organic, sourced from France or fair trade, produced with animal welfare in mind, and come in sustainable packaging.

More so, more brands are undergoing the fourth wave — lifestyle portfolio expansion. Learn more in our webinar, How to drive private label revenue in uncertain times, which highlights why retailers need to adapt to changing shopper behavior.

Product categories with the highest acceptance for store brands

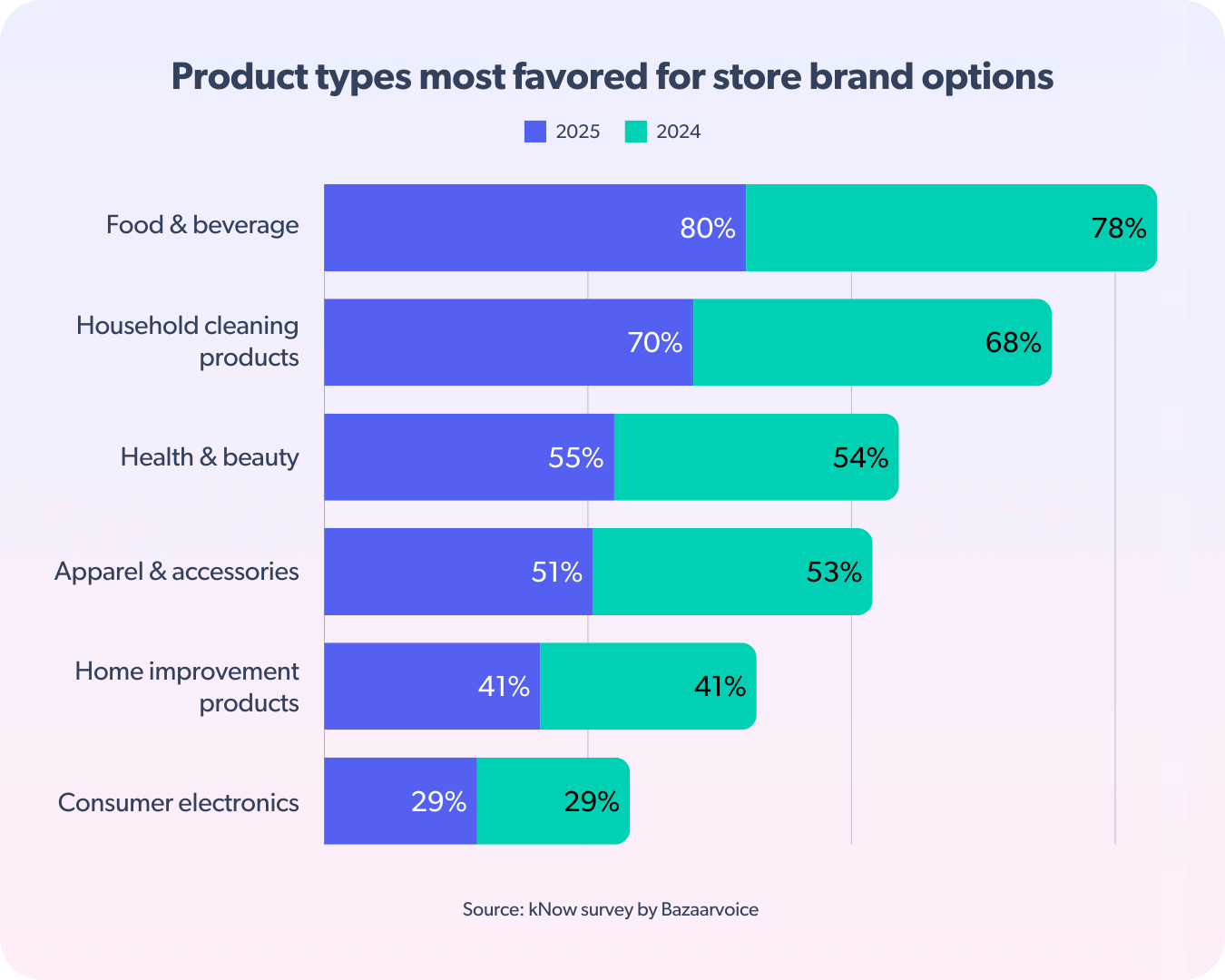

Evidently, essential purchases such as food and beverage, household cleaning products, and health and beauty items have remained the top three categories for private label product purchases over the past two years, closely followed by apparel and accessories.

Incentives and loyalty programs attract shoppers

Discoverability is at the forefront of all strategies, as store brands must differentiate themselves from national brands, particularly through retail pricing strategies, discounts, loyalty programs, and other incentives.

In one of our private label surveys conducted across North America in 2025, nearly two-thirds of respondents confirmed they had switched from their preferred brand to private label products due to a loyalty program or reward.

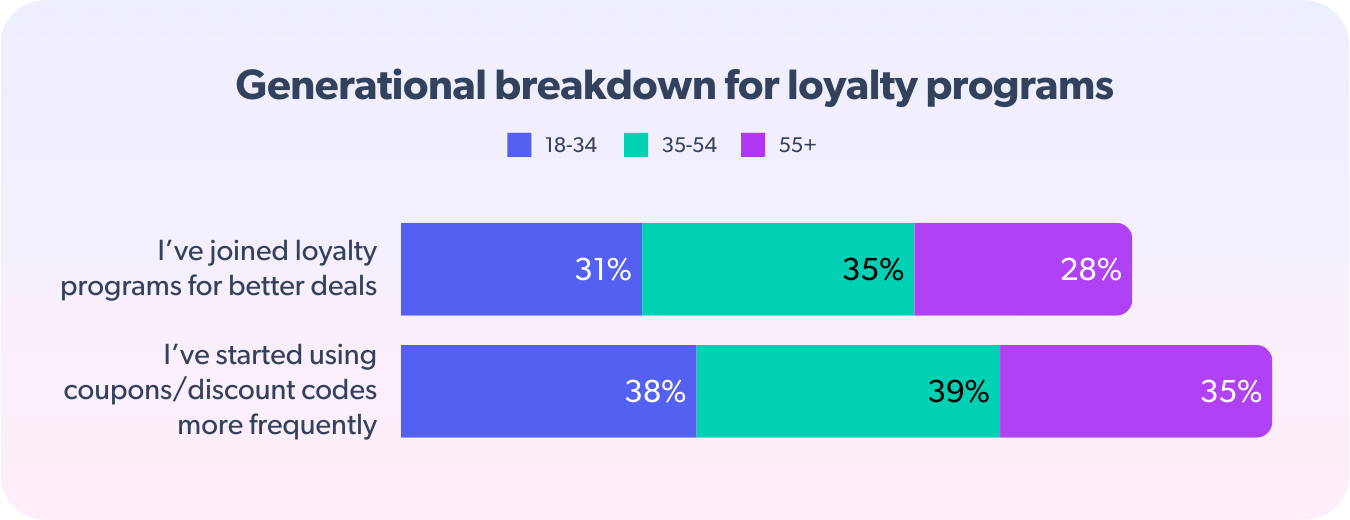

Even the SPR data shows that due to economic factors, almost 32% of shoppers have joined loyalty programs to find better deals. The generational breakdown shows that Gen Z and millennials are more proactive in joining these programs than older adults. However, when it comes to using coupons and discount codes, behavior is similar across all generations.

Conclusion

Shoppers want to save money by choosing private-label products over more branded and expensive alternatives. And it’s not just about the low prices. They also seek clear information and attractive deals. Attracting these customers requires retailers to highlight their product quality and value and add enticing offers.

Explore the main report to gain deeper insights into store brand success and evolving shopper behavior.