February 28, 2025

Shopping in France isn’t just an activity; it’s an intricate dance of culture, preference, and tradition. Drawing from Bazaarvoice’s proprietary Shopper Experience Index (SEI) Vol. 18, this exploration of French shopper habits uncovers how they blend the digital and physical, creating a shopping journey uniquely their own. France stands out in remarkable ways, both in where their journeys begin and how they make decisions.

Two sides of the coin

On one hand, 37% of shoppers begin their product search using search engines like Google—the second highest among all surveyed nations—while on the other hand, a notable 20% visit physical stores for their initial discovery. This indicates a strong preference for research-driven decisions. At the same time, their love for walking the aisles of a boutique is complemented by browsing digital catalogues to see what’s trending. Their shopping journey is informed and adaptive in its truest form. Online commerce trends in France are rarely a product of impulse. When they are not culturally characteristic, they are backed by impeccable reason, as evidenced by 34% of French consumers citing better prices online as the primary reason to switch from in-store to online shopping. In comparison, 14% are drawn to online-only discounts.

The French favour balanced and purposeful shopping

In France, flexibility is valued as part of the shoppers experience but decisions are guided by purpose. While 76% mix in-store and online shopping, 15% exclusively shop online, reflecting a growing trust in e-commerce among French shoppers.

Not to forget, 10% of those who prefer physical stores hold the fort in highlighting a cultural attachment to the sensate and social aspects of shopping. In France, browsing (whether online or in-store) is not limited to the need to find the best deal. It’s an experience rooted in interaction and style. The omnichannel journey in France is a finely tuned balance of research and exploration. The French are big on webrooming, with 74% of French shoppers beginning online, researching products before heading to physical stores. Fewer engage in showrooming, with 59% visiting stores to examine products before purchasing online.

Promotions, particularly in physical stores, are a significant driver—whether it’s a seasonal sale or an exclusive in-store discount, these offers compel shoppers to step out. This practice is most common within the apparel industry, with 46% of French shoppers queuing up at physical stores swayed by online promotions.

But it’s not just promotions that draw them in; the impact of customer experience in retail stores cannot be overstated. The ability to touch fabrics, test gadgets, or simply soak in a well-designed store’s ambience is valued highly in the French shoppers’ experience. For French consumers, these tactile and immersive experiences are as crucial as the product.

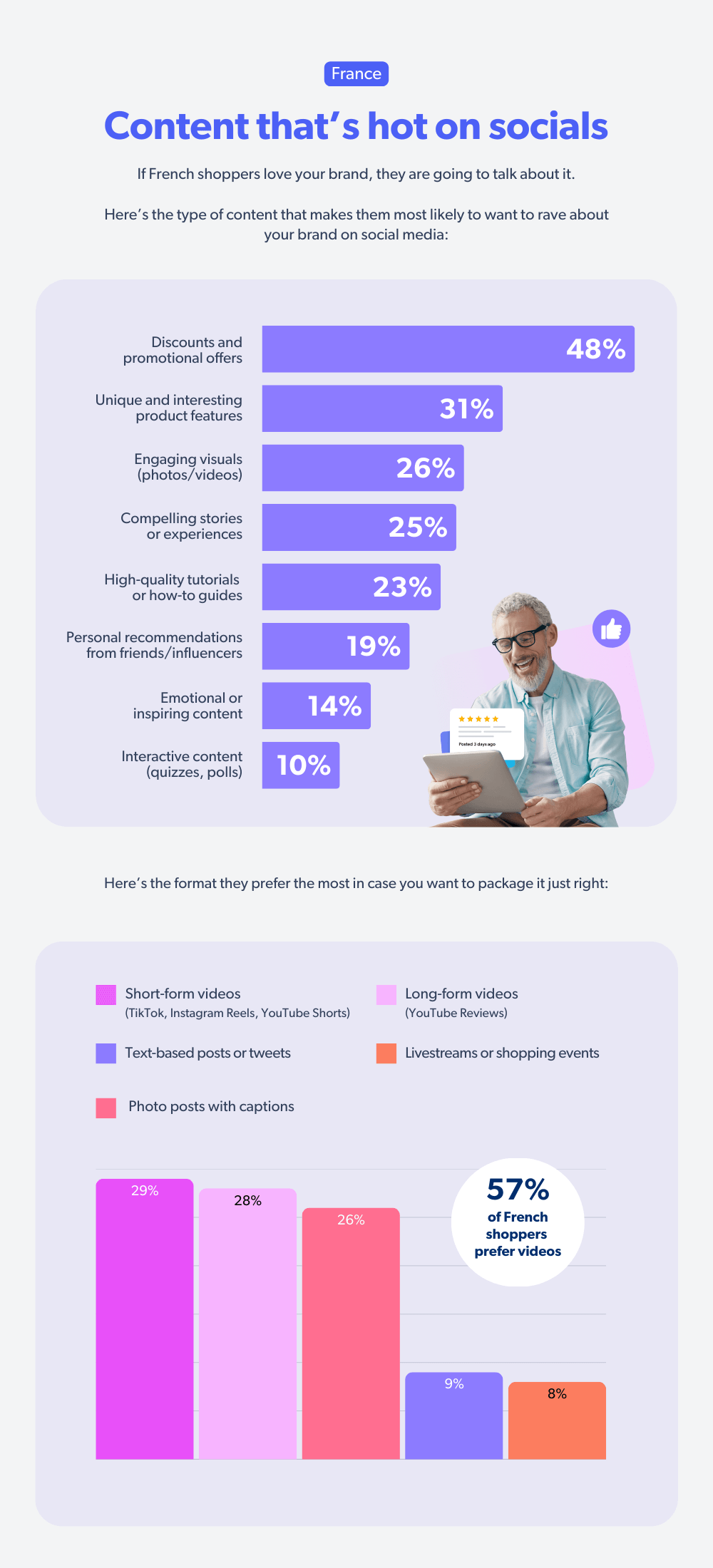

The emerging influence of social media in France

Unlike some markets where social media is the loudest voice in the room, France’s relationship with social commerce, particularly across platforms like Instagram and Facebook, is quieter but impactful.

Interestingly, while 30% discover new products while scrolling, and 24% make purchases directly through these channels, 35% of French consumers consciously avoid using social media for shopping, preferring more traditional or trusted methods. For brands wanting to amplify their social commerce game, this highlights an opportunity to rethink engagement strategies and offer authenticity and value rather than just amplifying noise.

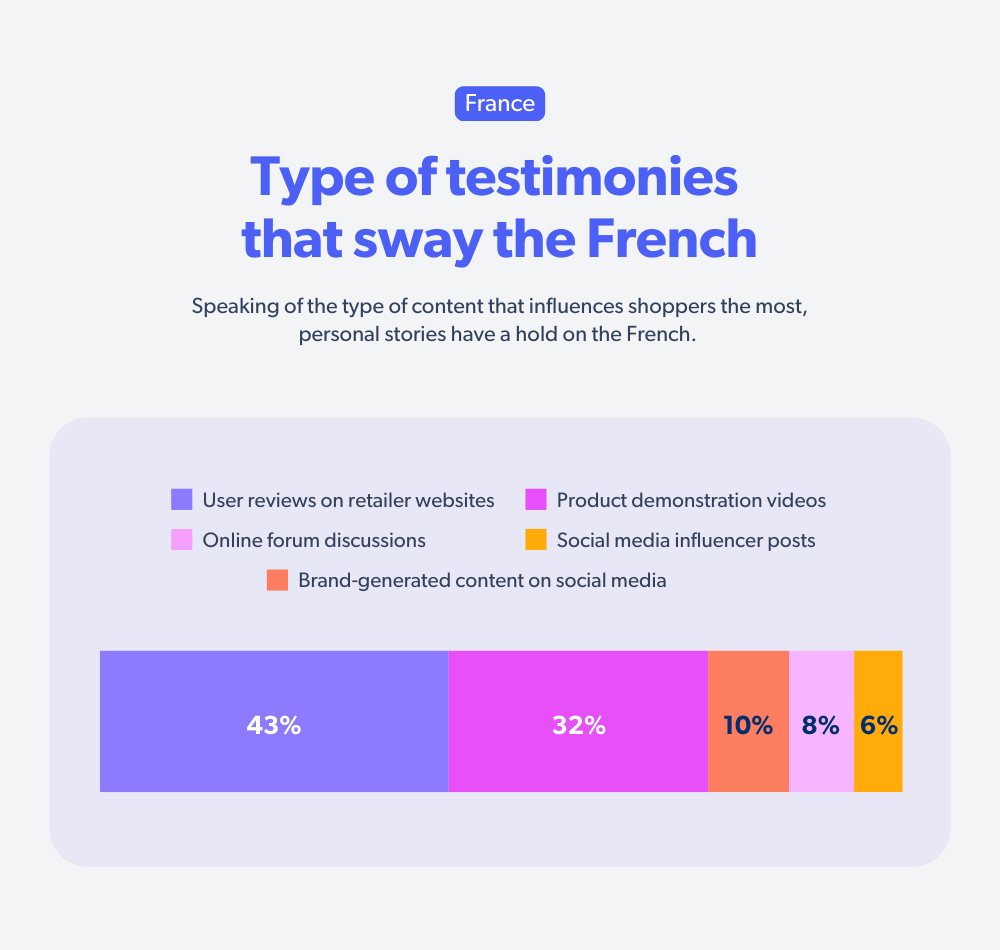

French shoppers trust UGC and the creators’ voices

In France, trust is the currency of shopping, and 62% of shoppers place great value on User-generated content (UGC). Reviews and ratings dominate, with 56% being most influenced by them in the shopping journey.

The French have a few rules of thumb regarding what they associate with review credibility — review volume. Compared to other countries, 46% of consumers require 11-50 reviews to make an informed buying decision and 59% are influenced by the higher total number of reviews when choosing between products.

Product demonstration videos also resonate with 32% of consumers, more than in most markets. French shoppers want to see products in action, bridging the gap between imagination and reality. The authentic voices of creators, who share both the good and the not-so-perfect, further amplify this trust.

Consumer voices shaping the shopping experience

The majority of French consumers have an affinity for sharing opinions on products, with 51% being happy to share their feedback as reviews when asked. However, 31% are passive, preferring to observe rather than contribute, while 10% are proactive creators, eagerly sharing their insights and influencing others. This mix creates a vibrant ecosystem where shoppers experience and voice, whether loud or subtle, play a part in shaping the retail narrative.

Closing thoughts: Shopping is another French art form

Shopping in France is more than a transaction. It borders on being an art form—a journey that balances trust, experience, and discovery. From the charm of in-store promotions to the precision of online research, French shoppers demand seamless integration across touchpoints. To truly influence consumer purchase behaviour, brands have their job cut out for them: deliver authentic content, curate immersive experiences, and honor the consumer’s desire for both information and inspiration. Fortunately, automated tools like Bazaarvoice Vibe can streamline content strategy and execution, making the process more efficient.

Shopper experience index vol.18