November 8, 2018

The holiday season is upon us yet again. If it seems like the holidays start earlier and earlier every year, that’s because they do. One in four shoppers get a head start of two months or more, forcing brands, retailers, and marketers to navigate a longer and more complicated advertising season. Shopping behavior greatly varies from person to person (especially during the holidays), so meeting customers where they are along the buyer journey with timely and effective advertising campaigns can seem like an impossible task.

Thanks to a recent study we conducted with the help of Wakefield Research, we have a much better picture of how, when, and why consumers shop during this busy season. From when they begin researching products, to when they’re most likely to purchase, to what their main sources of influence are, let’s look at a few key ways brands, retailers, and agencies can leverage this data to better optimize their holiday advertising strategies in time for the biggest shopping days of the year.

Define your marketing mix — and have backups

There’s no “one size fits all” approach when it comes to advertising, so the number one thing to account for is adaptability. With that said, it’s also important to understand what you have to work with early on and to pre-define a holiday advertising strategy based on your goals, available resources, and what the right marketing mix looks like for your business.

In terms of digital media, this means finding the right mix between search, social, display, and mobile web. Each channel should have its own strategy, but all should align with your high-level business goals, as well as your various buyer personas. For the holiday season, looking at last year’s campaign performance, web traffic, daily activity, and purchasing behavior between September and early January can help inform this year’s strategy. That being said, it is important to have a set strategy and then be prepared to shift with backup options.

Since it is November, and we are already seeing early holiday shopping activity, you should be looking at performance thus far and finding areas where you can adjust for better conversion rates and more efficient spending. It’s important to establish where budget can be shifted between partners or strategies, so as to allow for adjustments on the fly. Maybe your search strategy isn’t driving the expected amount of conversions, but display advertising is far-exceeding its conversion goals. Be prepared to adapt strategies quickly, allow for budget adjustments, and work with partners to quickly execute new campaigns at a moment’s notice, if necessary.

Make the switch from an awareness campaign to a conversion-driven one

Our advertising audience segments, sourced from 1.8 billion shopping signals across 6000+ brand and retailer websites, have a default 45-day look back period, allowing us to capture engagement data across the entire buyer journey, including product page views, ratings and reviews views, and conversions. This capability gives us a good idea of shopping behavior well ahead of major sales events like Black Friday and helps us to understand when consumers are in the discovery/research phase versus the purchase phase.

According to our holiday shopping data, Veteran’s Day, coming next Monday, seems to be the season’s inflection point, but certain product categories, like toys, holiday decor, and small appliances, see traffic spikes as early as this week.

In our survey, 59% of respondents categorized themselves as a “prepared shopper,” and they make a list and do extensive online research before making purchases during the holidays. Brands, retailers, and agencies should be targeting this group and those preparing to host Thanksgiving events now and over the next few weeks. Try out messaging around beating the rush and planning ahead and include early bird promotions, seasonal products, and festive holiday imagery.

Consumers are first and foremost after a good deal, and this is never more evident than during the Thanksgiving shopping weekend. In 2017, Black Friday saw the biggest spikes in traffic across 16 of the 20 product categories we looked at, and 53% of shoppers claim it as their primary shopping day. Thanksgiving Day is on the rise, which saw higher purchases and revenue last year than Cyber Monday. Thanksgiving was also the highest day for mobile sales at $624 million and had the highest average order value. Throw in Cyber Monday’s continued rise in popularity, and you can count on Thanksgiving weekend being your most significant sales opportunity and the ideal time to switch to conversion-driven campaigns that highlight price discounts.

When that time comes to focus more on conversion campaigns, you should also consider suppression tactics to ensure higher spend efficiency. Use data partners to include exclude people who have already made a purchase similar to the products you’re advertising and implement anti-targeting techniques based on your own internal CRM data. Not only do you save budget by not wasting an ad on someone who has already made a purchase, but you avoid annoying consumers with irrelevant ads.

Consider different types of ad creative

As mentioned above, price still has the greatest impact on a consumer’s decision to buy. When asked what aspect of holiday advertisements appeal to shoppers the most, 47% cited seasonal promotions or deals. Even planners who gain inspiration early in the season will tend to wait for price drops before purchasing, making competitive and attractive price offers the most impactful element of your advertising campaigns. If working with targeting partners, have them proactively hone in on shoppers looking at deals and price comparison pages — this is a great audience to start with, as they are easy to identify and ready to buy.

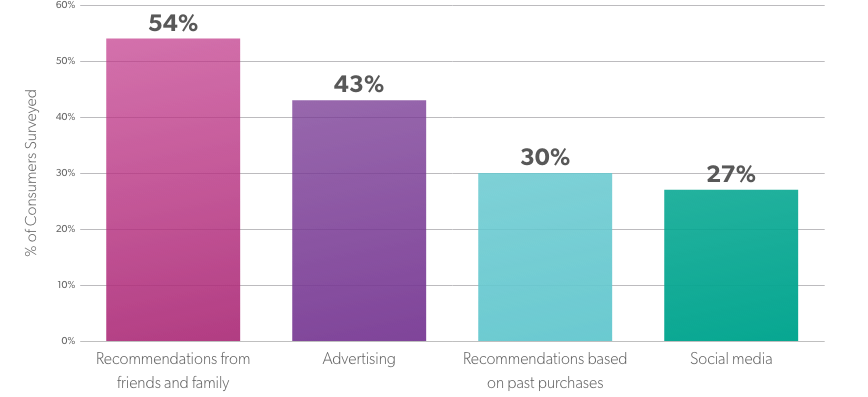

As impactful as price can be, shoppers are becoming more and more swayed by brand reputation and consumer-generated content (CGC), like ratings and reviews. 32% of our survey respondents reported that authentic advertising featuring product ratings and reviews and word-of-mouth content is the most appealing type of advertising message. The purchase likelihood for a product with five or more reviews is 270% higher than that of a product with none — consider highlighting real ratings and reviews in your ad creative to further sway shoppers. For our clients, these word-of-mouth ads have been seen to perform 2X better than ads that do not feature any CGC.

All that said, 43% of shoppers rely on holiday advertising for gift ideas, so it’s important that you include campaigns that foster discovery and inspiration in your always-on strategy. Social media is an especially suitable channel for these campaigns, especially for reaching more spontaneous shoppers who seek inspiration on the go. Address last minute shoppers with ads that highlight top-rated gifts and individually tailored product recommendations. To easily move someone from discovery to purchase, take advantage of the rising social commerce trend by including “Buy Now” functionality within social ads, especially on Pinterest and Instagram. Similarly, when consumers shop for others, their level of consideration is lower, and their shopping journey concludes faster than when they shop for themselves. With this in mind, it’s particularly important to target consumers as soon as they switch from discovery to consideration mode. For example, Bazaarvoice targeting can show ads to someone within one one day of engaging with relevant product pages.

Use a data-driven, adaptive approach to your holiday advertising strategy

Your holiday advertising campaigns are likely well underway, but there is a long way to go and a lot of opportunity on the table. Ad inventory is competitive and expensive during this time of year, so reach your best customers efficiently by optimizing your marketing mix, running timely conversion and discovery-driven campaigns, and experimenting with different types of ad creative.

Fast-approaching the most popular shopping weekend of the year, now is the perfect time to review holiday advertising performance and adjust accordingly. Use your own insights from years past, and be sure to check out our Holiday Headquarters for more consumer behavior trends and holiday shopping data from 2,500 consumers and over 6,000 brand and retailer websites.