February 19, 2025

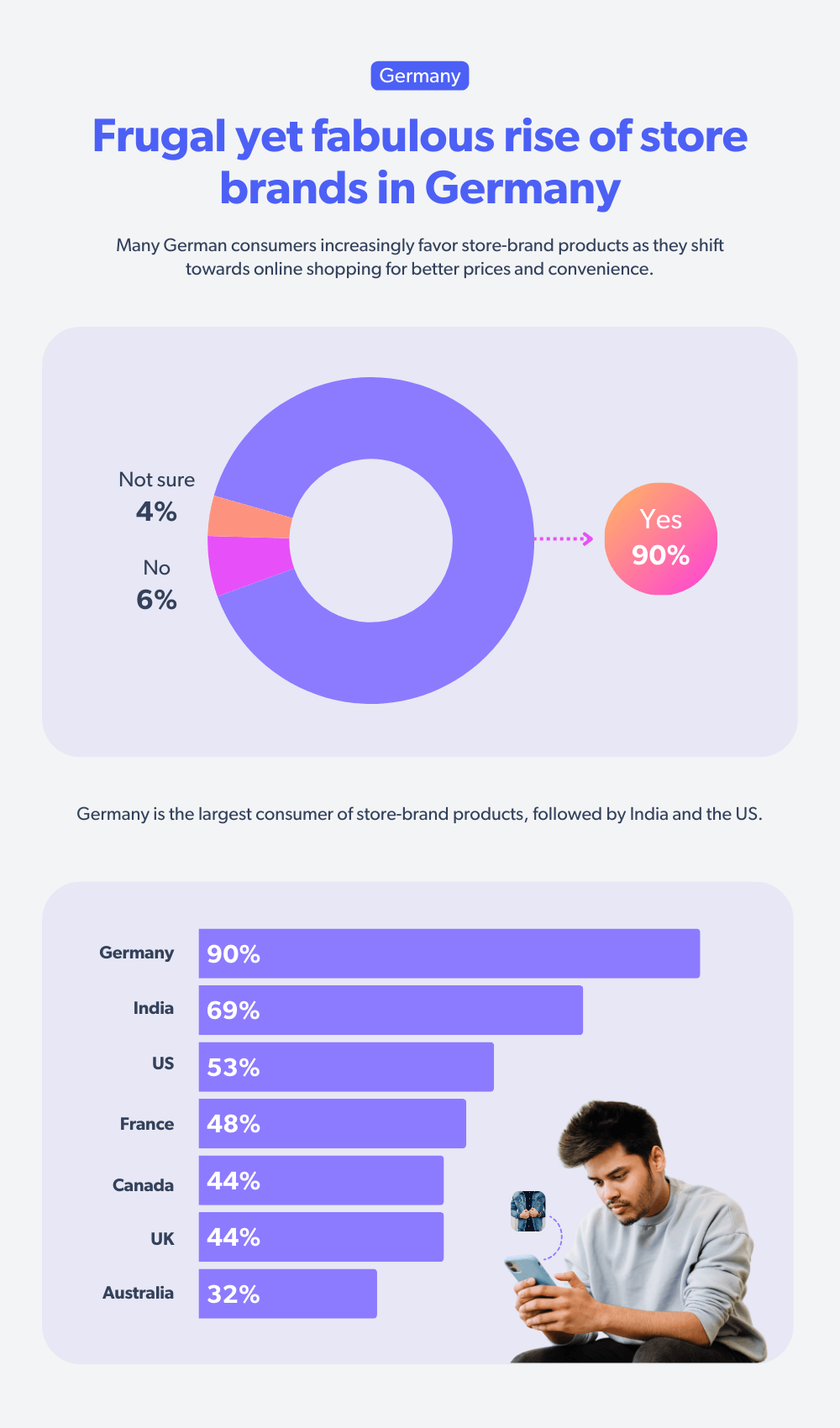

Call it the effect of low prices or retailers offering high-quality private-label brands to simplify consumer choices during their purchase—German shoppers have shown a strong preference for private-label products (also known as store brands).

According to the Bazaarvoice Shopper Experience Index Vol. 18, over 90% of German consumers purchased private-label brands in the past year. This far exceeds the global average of 54%, highlighting a distinctive consumer behavior in the German market.

This preference for store brands does not deter German shoppers from embracing online shopping trends or diminish their demand for a seamless omnichannel experience—whether shopping online, in-store, or even via social media.

German consumer behavior also reflects a growing influence of trends in online shopping, with shoppers seamlessly blending digital research and in-store visits to make informed purchases. Their focus on convenience, flexibility, and personalization underscores their ability to adapt to evolving trends in the retail industry.

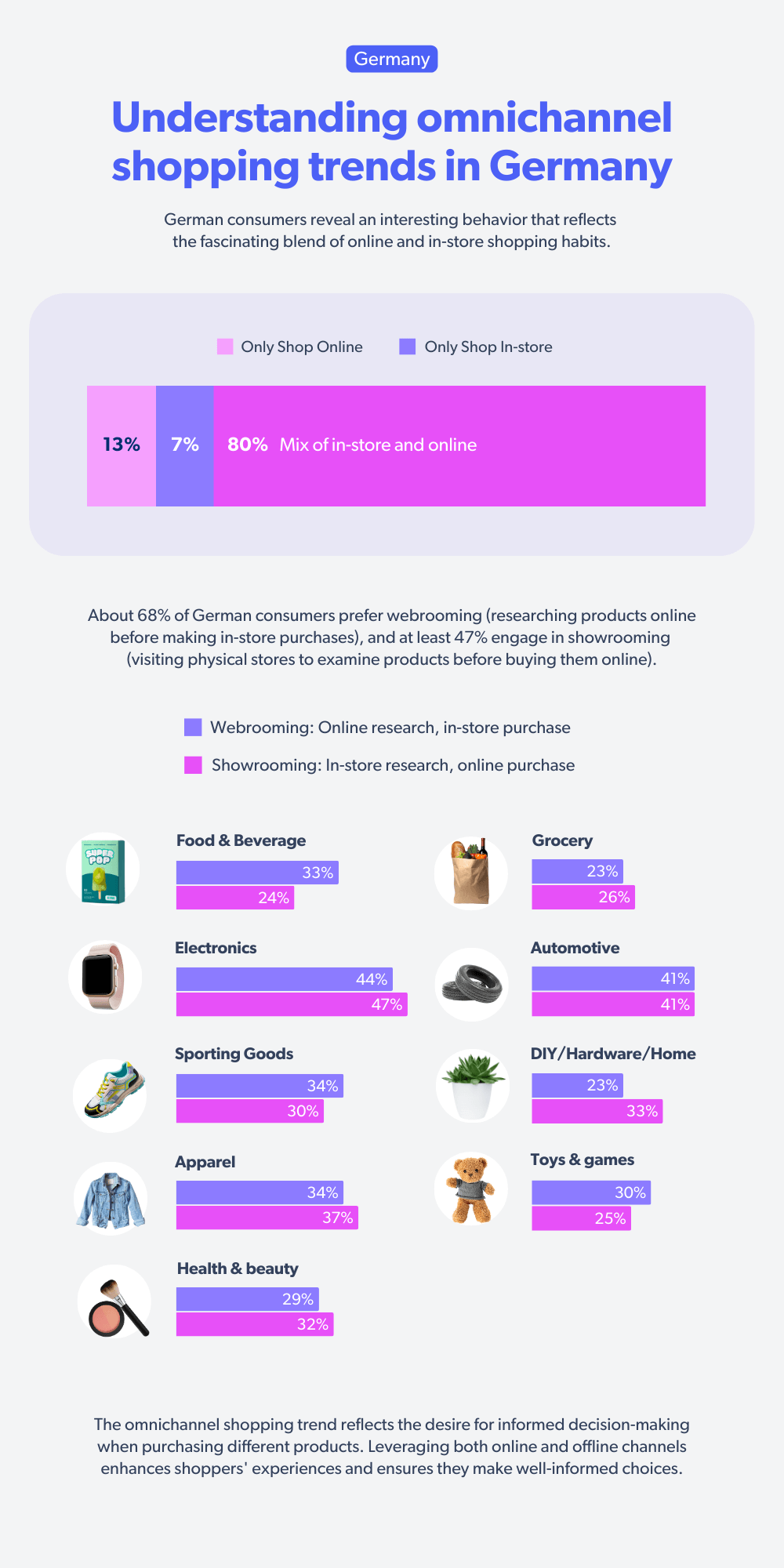

Omnichannel shopping keeps up the momentum

Four out of five (80%) Germans prefer a mix of in-store and online shopping. 47% of consumers purchase online monthly, which is higher than the global average of 39%. This reflects key online commerce trends, indicating a formidable transition in integrating digital experiences with traditional retail.

The primary reason for Germans to switch from offline to online shopping is the better prices available online (32%), followed by easy home delivery (18%) and online-only discounts (14%).

This fascinating blend of shopping habits showcases how German consumers are becoming savvy digital and physical retail navigators, embracing the benefits of omnichannel shopping to find the best deals and convenience.

Interestingly, shoppers engage in both webrooming and showrooming behaviors. At least 68% search for information online and then purchase the product in-store, a practice known as webrooming. Similarly, about 47% visit physical stores first and then buy products online, referred to as showrooming.

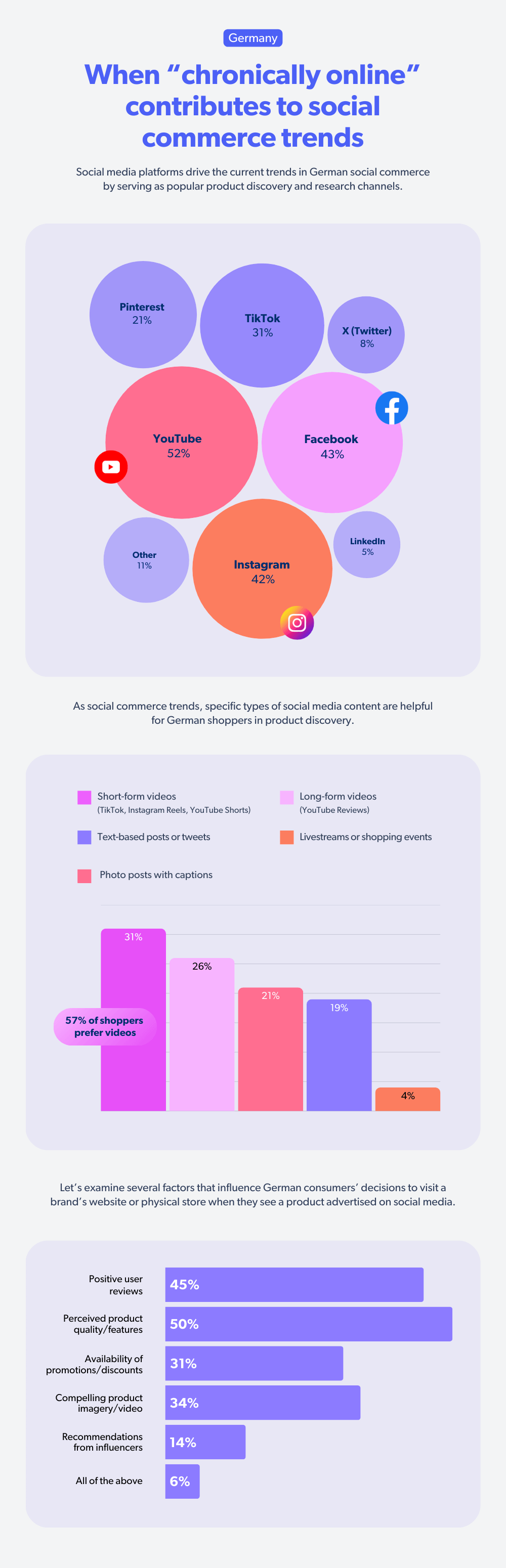

Redefining the era of social commerce trends

Shopping on social media—also known as social commerce—has significantly influenced German consumers’ purchase decisions.

YouTube holds the baton, with 52% of German consumers using it for product discovery, closely followed by Facebook (43%) and Instagram (42%). These shoppers prefer short-form videos (31%) over long-form videos (26%). If you are a brand trying to crack the code to expand your reach, try Bazaarvoice’s social commerce solution.

Understanding German consumers’ social media shopping behaviour is crucial for brands and retailers. At least 43% of shoppers turn to social platforms to discover new products, while 30% browse for items they’re already considering, and an equal 30% use social media to make direct purchases.

In social commerce, organic and sponsored ads influence 30% of shoppers, while 23% value the convenience of purchasing directly through social platforms. This trend highlights a significant shift, as the consideration phase in the buyer’s journey is becoming increasingly shorter.

Notably, 56% of German shoppers make purchases via social media at least once or twice a month, highlighting the platform’s growing role in their shopping habits.

Hence, according to social commerce trends in Germany, shopping is all about quality and affordability. What type of content are consumers looking at to gather information about their products?

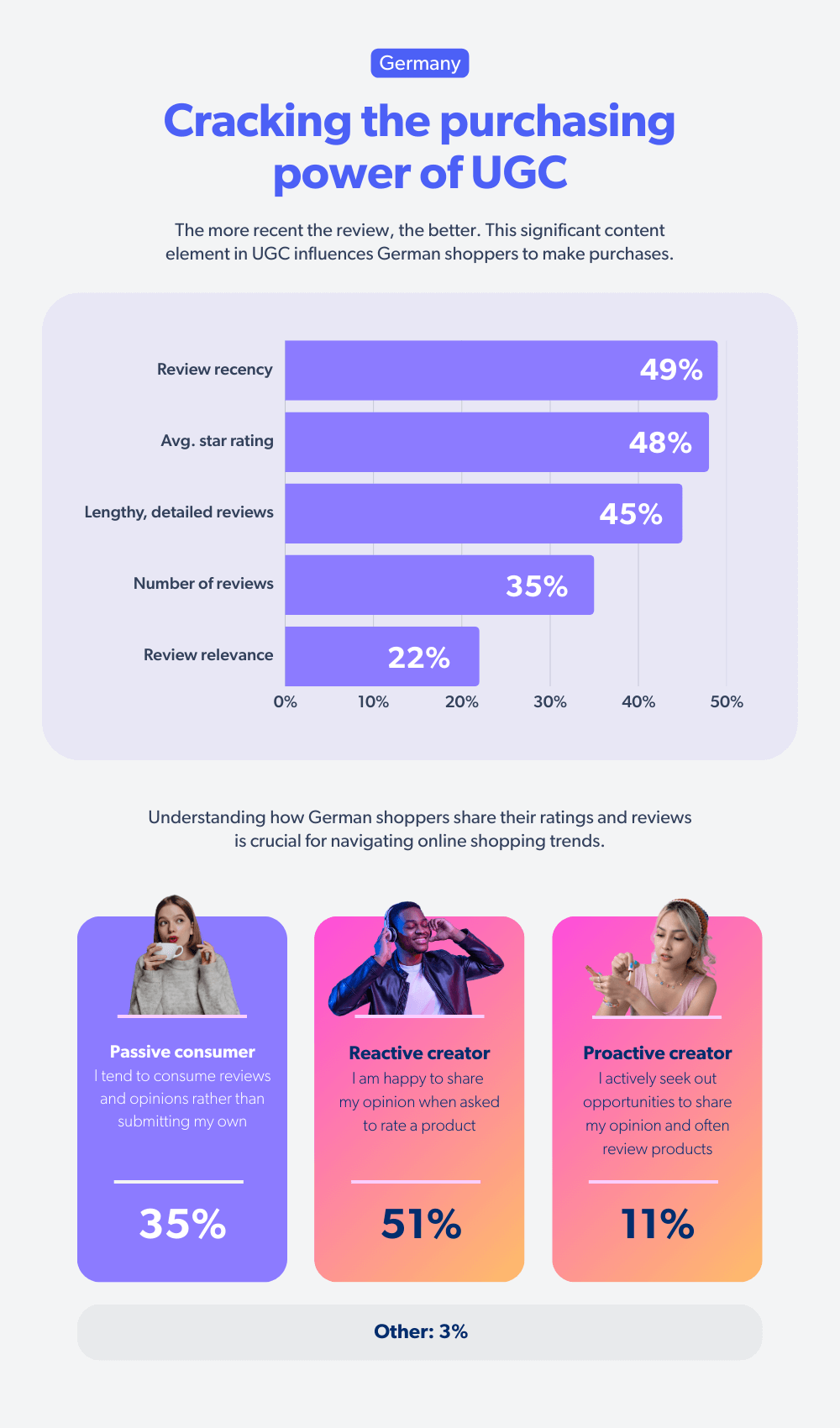

UGC and creator content levelling up

User-generated content (UGC) plays a crucial role in influencing German consumers, with 69% finding it valuable in their path to purchase.

For SEI, we have considered the following types of UGC: photos and videos, ratings and reviews, comments and replies, testimonials, and forum posts and discussions. The impact is clear — close to one in two shoppers are more likely to make a purchase based on it.

When it comes to key factors shaping purchasing decisions, 49% of shoppers consider the recency of reviews critical, while average star ratings influence 48%. Additionally, 45% of consumers place significant value on detailed, in-depth reviews—indicating a strong preference among German shoppers for comprehensive insights compared to their global counterparts.

This emphasis on reviews and ratings is crucial in enhancing shoppers’ experience, as it empowers them to make informed decisions based on reliable information.

“We know UGC isn’t the future — it’s now. So how do we incorporate all of this great social content from the customers that we already have?”

– Brittany Uhal, Senior Manager of the US e-commerce team at Fresh

The two most common categories in which German consumers look for UGC content are electronics (65%) and apparel (49%), which are higher than their global averages of 62% and 46%, respectively. The likelihood of purchasing electronics and apparel is 41%.

Creator content that highlights a product’s pros and cons is pivotal in influencing German consumers’ purchasing decisions. Honest reviews drive 56% of shoppers to purchase, while 40% rely on creators for detailed product information and specifications.

The survey reveals interesting trends regarding rating products—whether as shoppers or creators. More than half (51%) of German consumers are willing to share their opinions when prompted, indicating a strong willingness to engage when encouraged. However, 35% remain passive consumers, preferring to read reviews rather than contribute their own.

On the other hand, only a small but dedicated 11% of shoppers actively seek opportunities to share opinions and frequently review products, also labeled as proactive users. This highlights a niche but impactful segment within e-commerce in Germany.

Personalization as a shopping trend in Germany

Let’s discuss personalization and whether it is affecting German consumers. We know that discounts and promotional offers perform better than loyalty rewards.

At least 37% find personalized discounts, offers, and promotions influencing their decision to complete a purchase on an online shopping platform. Be it offline or online, German consumers prefer it mainly for apparel, electronics, and health and beauty.

Ultimately, this reflects exciting trends in the retail industry, where tailored experiences are a substantial part of consumer expectations.

Conclusion

German consumers are increasingly embracing the omnichannel shopping experience and moving considerably towards social commerce purchasing.

As brands respond to these trends, prioritizing quality, competitive pricing, and personalized experiences will be crucial for capturing the attention of the savvy German consumer.