February 27, 2025

In today’s digital-first world, Canadian shoppers are redefining how they shop, blending in-store and online experiences like never before. Compared to the global average of 80%, an impressive 88% of Canadians want a mix of in-store and online shopping experiences, according to the Bazaarvoice Shopper Experience Index, Volume 18.

And at the heart of their purchasing decisions lies authentic customer feedback — user reviews on retailers’ website — the most influential factor in their purchase decision. Let’s delve into some fascinating aspects that shape Canadian consumers’ decision-making process.

What omnichannel means for Canadian shoppers

At least 30% of shoppers in Canada start their shopping journey with an online search, while another 30% head to online retailers and marketplaces such as Amazon. Interestingly, only 18% begin by visiting physical stores.

An impressive 88% of Canadians want a mix of in-store and online shopping experiences, highlighting the need for brands and retailers to adopt robust omnichannel strategies, ensuring they are present and optimized across every touchpoint.

This omnichannel buyer behavior is further determined by the fact that 76% of Canadian shoppers search for information online but then visit physical stores to confirm the details, try products in person, and save on shipping costs.

Conversely, 55% gather information in stores and later purchase online, driven by better prices, easy home delivery, and wider product selection. For many, online-only discounts and in-store stock shortages also play a role in this behavior shift.

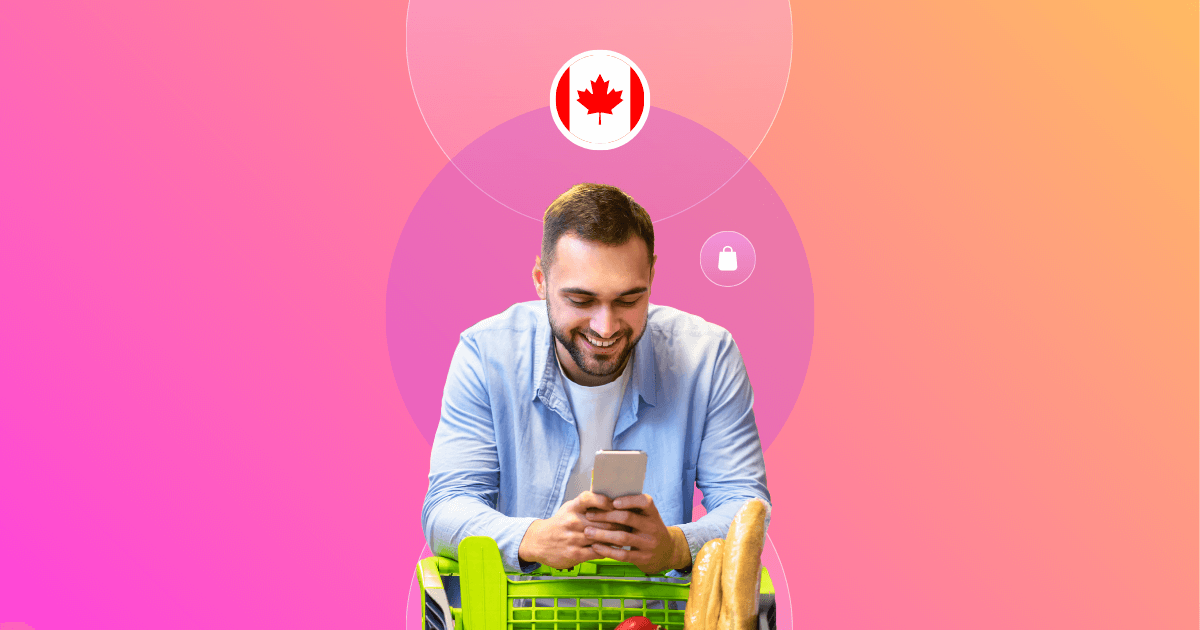

How social media shapes the shopping journey for Canadian consumers

Social media continues to bridge the gap between discovery and purchase for Canadian shoppers. About 48% engage with positive user reviews on social platfoms, perceived product qualities influence 38%, and 36% are drawn by promotions and discounts.

Platforms like Facebook and YouTube play a pivotal role in product discovery and research, with 51% of shoppers engaging on these platforms. While Instagram’s engagement lags slightly at 38%, it still contributes significantly to stimulating interest in products.

Interestingly, 41% of Canadians use social media to browse for products they are already interested in, surpassing the 38% who use it to discover new products. About 28% go a step further, making purchases directly on social platforms.

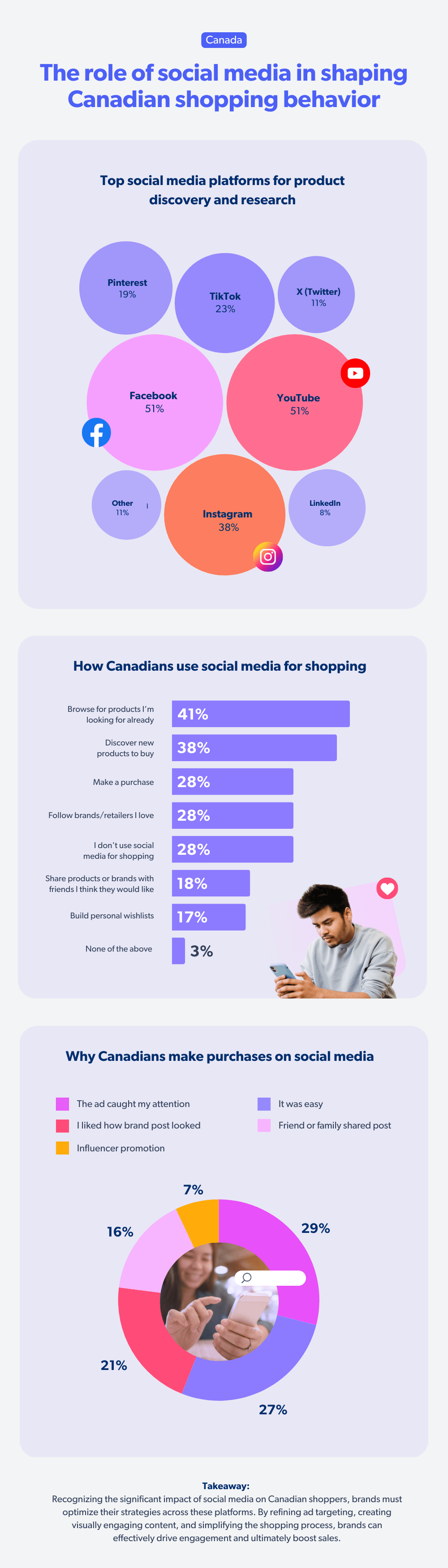

How User-Generated Content (UGC) shapes buyer behavior in Canada

UGC plays a pivotal role in influencing Canadian shoppers’ decisions. A striking 65% of shoppers consider UGC—including ratings, reviews, photos, and videos—essential to their shopping journey, and 46% frequently use it to influence their purchases.

The impact of UGC is amplified when reviews are both recent (1-3 months old) and numerous (11-50 reviews). When asked about the likelihood of making a purchase based on UGC, 57% of shoppers confirmed its significant influence. Ratings and reviews stand out as the most valued forms of UGC.

Brands and retailers can streamline the shopping journey by focusing on the UGC elements that drive buyer behavior. For instance, 60% of Canadian shoppers prioritize average star ratings, while 48% value the recency of reviews and another 48% focus on the number of reviews available.

Wondering how recent reviews should be to make an impact? Among Canadian shoppers, 42% actively engage with reviews that are 1-3 months old, surpassing the global average of 39%. Additionally, 40% prefer seeing 11-50 reviews before committing to a purchase.

So, what are shoppers looking for in UGC? Understanding their priorities can help brands and retailers craft more relevant and compelling content. Notably, 59% of shoppers seek insights into value for money, while 51% focus on the quality of materials. Aligning strategies with these expectations can help businesses enhance shopper satisfaction and drive conversions.

The power of authenticity: How creator content drives shopper decisions

When it comes to rating products, Canadian shoppers are eager to share their opinions . While 33% of consumers prefer to take a passive role, focusing on reading reviews rather than contributing, a notable 9% actively seek opportunities to share their thoughts by frequently submitting reviews.

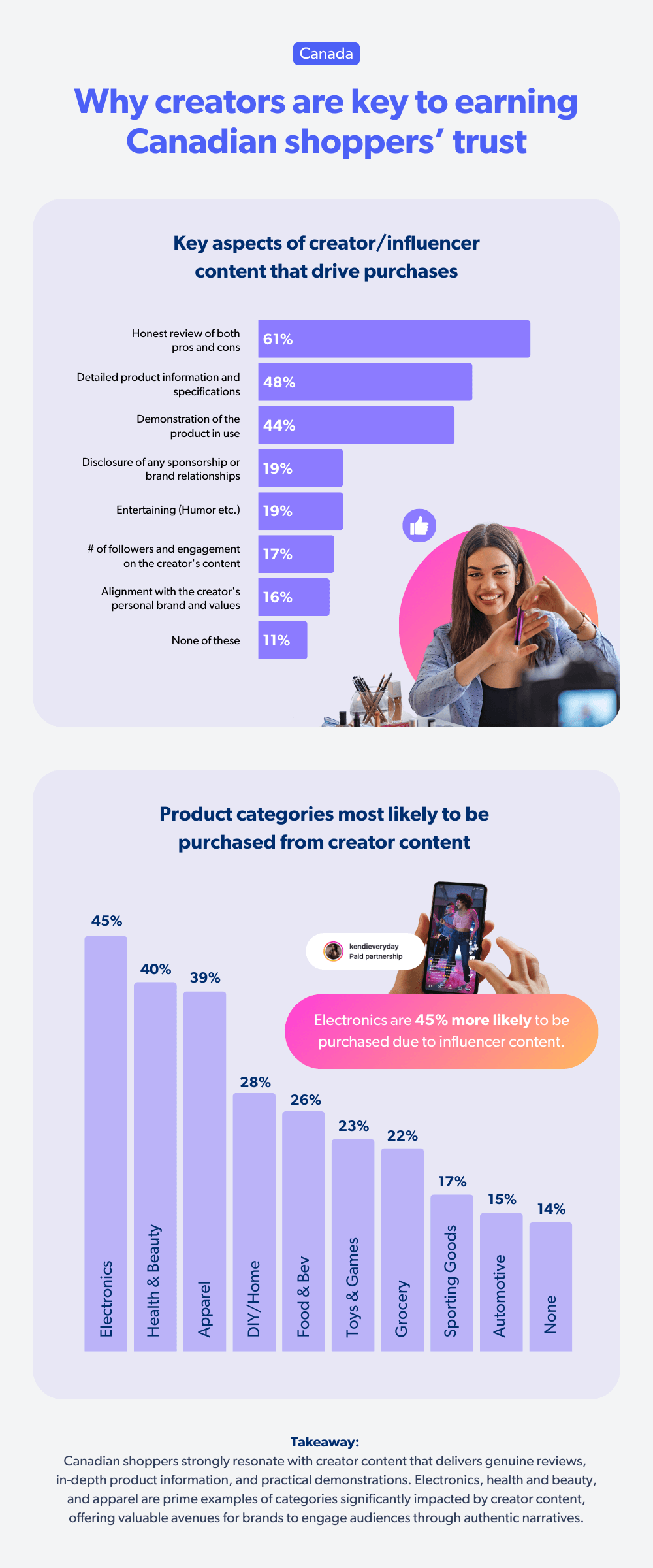

Creator content has a profound impact on purchase decisions. Among Canadian shoppers, 61% value honest reviews that include both pros and cons, making transparency a key driver of trust. Additionally, 48% are influenced by detailed product information and specifications, while 29% are swayed by product demonstrations that show items in action.

For brands and retailers, these insights on buyer behavior sheds light on the importance of prioritizing authenticity and depth in creator partnerships. By focusing on these types of content, businesses can effectively engage their audience, build trust, and drive conversions.

Canadian shoppers driven by personalization and loyalty

To gain the loyalty of Canadian shoppers, SEI survey reveals that 36% feel loyalty rewards and exclusive member benefits make them feel valued and increase their brand loyalty.

For 35%, these incentives motivate them to shop more frequently, while 32% say they influence their decision to choose one brand over another.

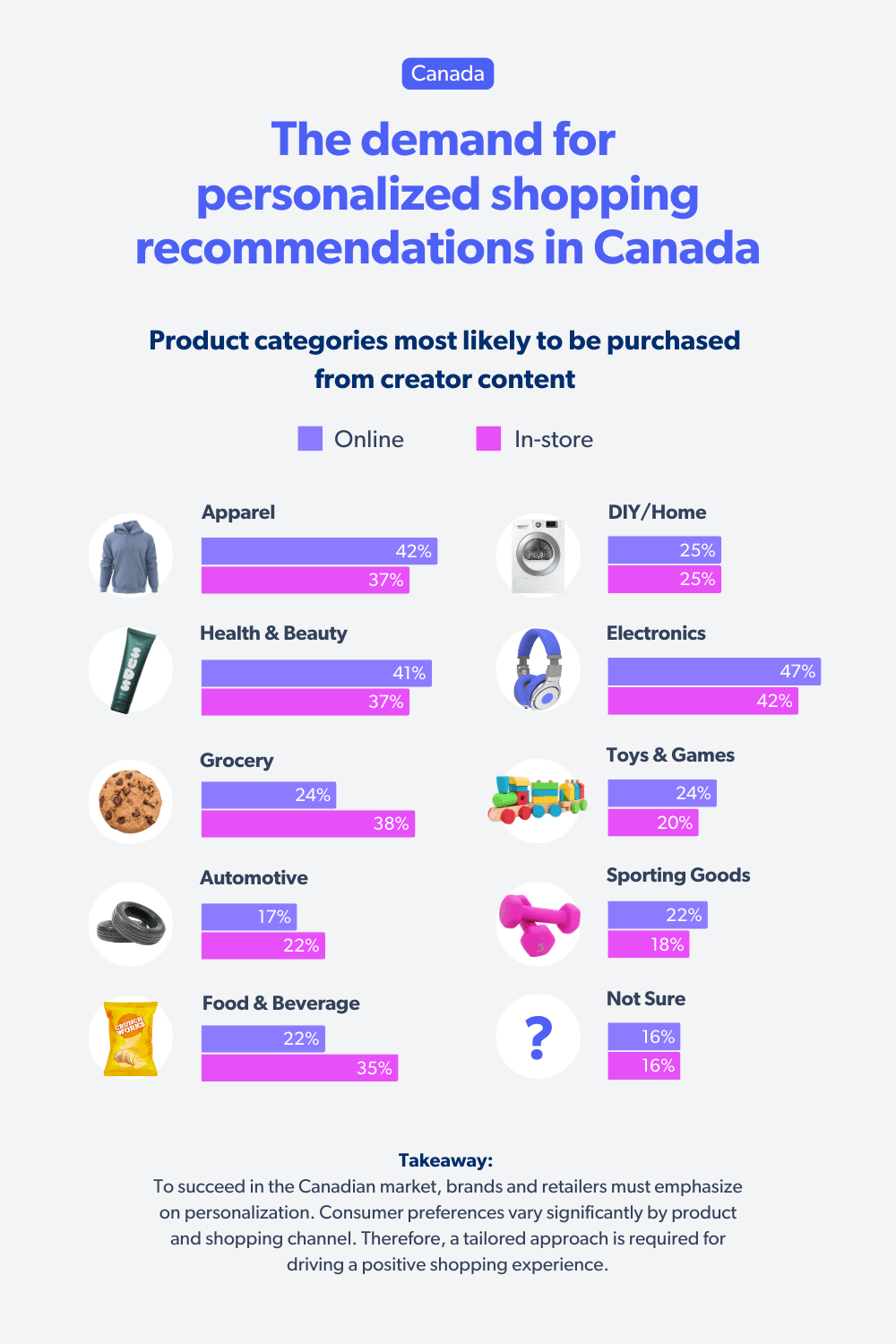

Personalized product suggestions also play a significant role in shaping the buyer behavior, with 28% of shoppers showing a higher likelihood of making unplanned purchases on e-commerce sites when these are offered.

Additionally, 33% of shoppers are significantly influenced by personalized discounts, offers, and promotions, highlighting the importance of tailored experiences in fostering customer engagement and loyalty.

Conclusion

Consumer behavior in Canada highlights the critical need for brands and retailers to be present at every step of the purchase journey. For those seeking an all-in-one platform to manage creator marketing, UGC, and social commerce while tracking performance, Bazaarvoice Vibe is the perfect solution.