June 24, 2017

This is the first post of our Back to School with Bazaarvoice series.

Back-to-school is big business for retailers. How big? It’s the second most popular shopping window of the year, behind the holidays, and for the past two years, shopper spend has increased by 10% or more. If that trend holds for 2017, back-to-school spend will surpass $80 billion.

Smart advertisers are poised to take advantage of this important shopping surge by leveraging actionable insights to fuel their campaign strategy. To inform this strategy for the upcoming 2017 season, we analyzed Bazaarvoice Network data from last year’s back-to-school season to uncover trends and shopper behavior. Over the coming weeks and months, we’ll outline our tips to help advertisers ace this back-to-school season.

Lesson #1: Budget your back–to–school advertising spend around product–specific shopping spikes.

Unlike the holiday shopping season with its well-defined shopping window, our data showed that back-to-school presents a more complex terrain for advertisers to navigate. Consumers make purchases for different things at different times and over the course of several months. The shopping window begins as early as July but drags out longer, with peaks and valleys that vary based on shopper persona and category. The majority of back-to-school shoppers research and buy items throughout the summer, and they are beginning their search as early as July. What’s more, a third of shoppers say they’re not done buying until after the school year begins.

In fact, the three biggest back-to-school categories — consumer electronics, office supplies, and clothing/apparel — have incredibly distinct seasonality trends, forcing marketers to think about their back-to-school strategy at the category or even SKU-level in some cases.

With this wide-ranging period of time, advertisers need to be savvy about their pace of spend as the season progresses. One way to approach this challenge is to look at the exact window when people are shopping across the three major back-to-school categories. Back-to-school shopping for consumer electronics spikes first, then office supplies, and finally clothing/apparel finishes the season.

Let’s look at a seasonality breakdown for each.

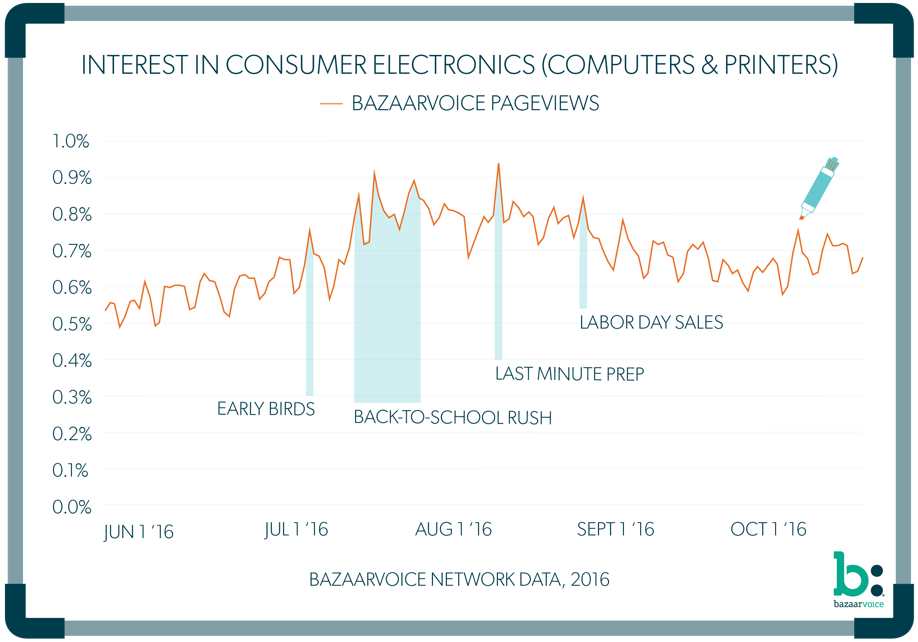

Consumer Electronics: Checking off big ticket items first

- Shoppers in this category, presumably college students and their parents, begin their search early, ticking off their biggest ticket items, like laptops and printers, as early as July. One explanation for this could be that college students head to school earlier than K-12, commonly in mid-August, so they will have an earlier idea of what kind of laptop is needed for college.

- From July 8 to August 22 in 2016, shopper activity increased 40 percent over the prior month. Mondays were the biggest day for product pageviews in this category. After enjoying summer weekends, shoppers go back to their checklist at the start of the week.

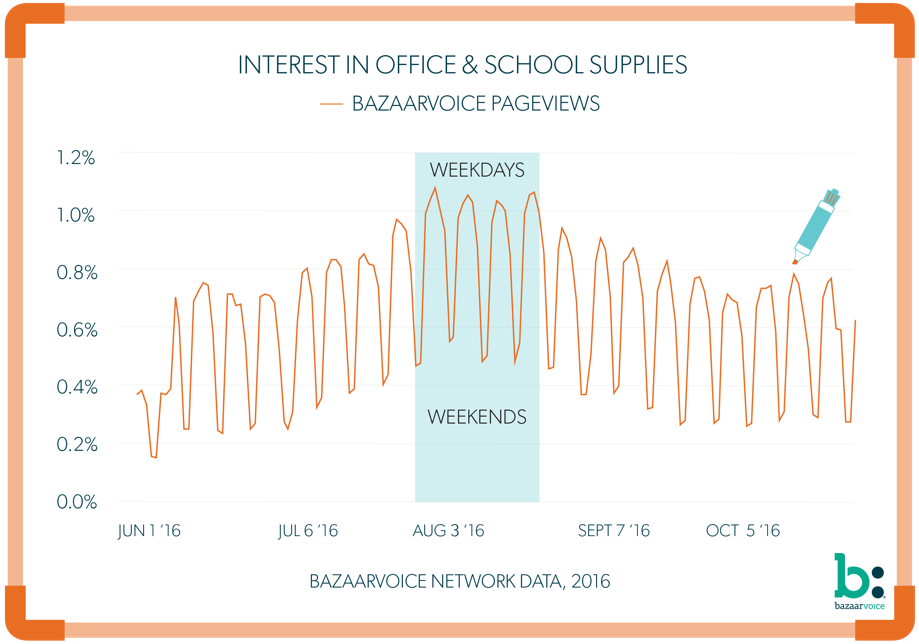

Office Supplies: Stocking up in August

- Office supplies is the next category to trend. As teachers send out their supply lists, parents begin to stock up on these items in August. The second peak in September indicates a second, smaller rush for forgotten items.

- Pageviews in this category were highest mid-week (Tuesday, Wednesday, & Thursday). After all, who wants to spend their weekend shopping for office supplies?

Clothing/Apparel: Last–minute trendspotting

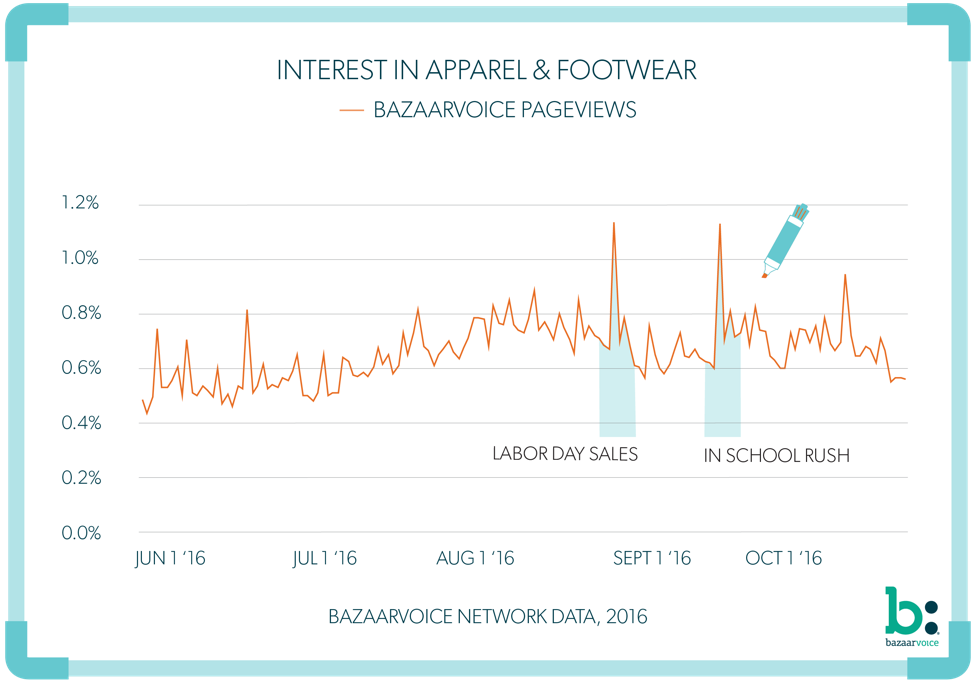

- Clothing/Apparel is the last of the major back-to-school categories to spike. Shopping peaks in late August, spikes for Labor Day sales, and steadies through September. Perhaps shoppers are awaiting colder temps or opt to track trends after school begins.

- Nearly 60% of product pageviews occurred on mobile devices, indicating that shoppers prefer researching and showrooming from their smartphones rather than from their computers. Mobile-first Gen Z’ers are now college students who most likely make up a good deal of the mobile shoppers.

Homework for advertisers: Study up on seasonality

Together, these insights derived from our shopper data allow advertisers to understand when their shoppers are in-market for their products and better target shoppers during the right window of time for each of the three major product categories.

With back-to-school budgets on the rise, brands and retailers should be optimistic about their opportunity heading into the warmer months. Class might be dismissed for the summer, but now is the time for advertisers to study up on their shoppers and craft a strategic digital advertising strategy informed by the complex seasonality nuances of back-to-school season.

For more lessons on back-to-school advertising, download our infographic and keep up with our Back to School with Bazaarvoice series over the summer months.